Table of Contents

The #NewNormal is causing companies to re-balance their sheets. What are the steps organizations can take to reduce the pressure on the coffers? #WFH is a start. It has already contributed its bit in checking infrastructure and real estate costs to reduce fixed costs(apart from opening new vistas when it comes to efficiency and productivity). Blending an incentive based pay component into the compensation structure offers another way forward. Not only can it help us get a grip over fiscals, improving efficiency and strengthen business continuity postures during crisis, but the model carries enough potential to revolutionize business approaches even in the long term when the going is good.

The essence of a ‘performance based pay’ is as old as mankind. The concept is not restricted to workplace rewards either: Disposable pens and paper plates work pretty much on the same principle. As a business practise, PRP (Performance-Related-Pay) was ‘officially launched’, so to speak, in the UK in the 1980s. The benefits of a pay package that is designed around efficiency and productivity is a familiar modern-day practices in industries such as insurance, delivery, financial services, factories and food & beverage, to name some. Network Marketing (or MLM – Multi Level Marketing) derives its juice from a similar spot. Not surprisingly, the idea has always resonated strongly with companies and business leaders across geographies and generations. Organizations like IKEA, Coke and Pepsi are famous for their PRP schemes that have kept evolving brilliantly with the times.

Business case for incentive-based pay to reduce fixed costs and improve efficiency

Variable pay schemes can vary – from incentives to bonuses to profit sharing to ESOPS to in-kind to a host of innovative ideas. The common thread knitting them is the conviction that rewards must be a close function of performance.

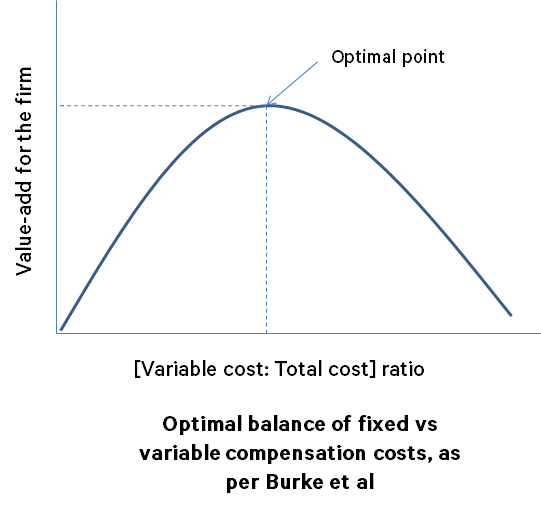

The benefits of an elastic pay scheme – one which is characterized by a lower fixed and a higher variable package - first came to light in 2004, when the economic framework of Terry and Burke demonstrated that a reduction in operating leverage essentially translates into a percentage gain in profits. Before them, Rendell and Simmons had, in 1999, shown the world that variable pay – when deeply integrated with the organizational ethos and purpose - reduces profit volatility and enhances the earnings stream for shareholders. As volatility goes south, it drags the company’s Beta Coefficient (i.e. market risk as assigned by market investors) down with it. This reduces the cost of capital (Beta) of the firm. Net result? The economic value of the business goes up.

A VUCA (Volatile-Uncertain-Complex-Ambiguous) climate has only given Variable Pay (Performance Related Pay) a big push forward - causing even industries and niches that are not traditionally associated with the idea - to give it a serious thought.

Stats say that companies across sectors are increasing Variable Pay (specifically, pay aligned with performance) share by as much as 15% in order to tone down expenses. In the opinion of Arvind Usretay (Director of Rewards at Willis Towers Watson, a risk management advisory), sectors such as FMCG, e-commerce, pharma, financial services, IT and fintech will spearhead a ‘near mass exodus’ to a Pay-for-Performance paradigm.

AT THE HEART OF IT IS ELASTICITY

While it is common management wisdom that turning processes ‘stretchable and malleable’ helps teams stay agile and adaptable to change (an important ingredient in maintaining competitive edge), not many CXO’s or founders have looked at compensation through an elastic framework. Till now, that is. Anandorup Ghose, partner at Deloitte India, opined in the Economic Times : “The crisis has highlighted the inelasticity in compensation costs and there will be a move towards making these more variable over the coming years.”

BENEFITS OF ELASTIC PAY THAT’S LINKED TO PERFORMANCE LOOPS AND IMPROVING EFFICIENCY

- TURN MEDIOCRE PERFORMERS INTO ROCKSTARS

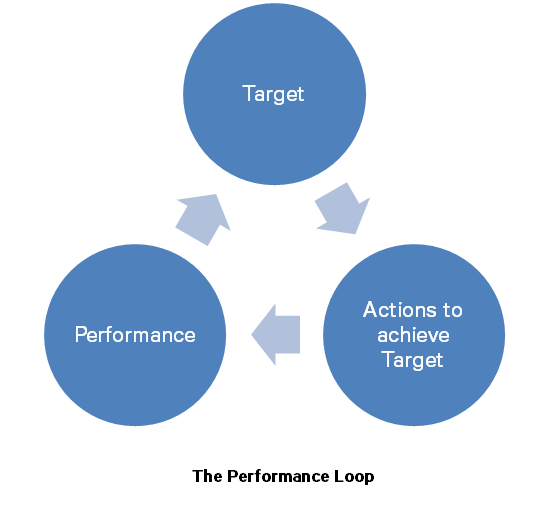

Despite having the best strategy, tech and talent, it is possible that your organization is operating at a fraction of its potential. The trick is to turn a ratio of the compensation structure variable – and sync it with a ‘performance loop’.

What does a ‘performance loop’ do? In short, it is a cycle where pay is driven by performance and, equally by extension, drives performance. And how does one arrive at that ratio? There are no readymade formulae, and each company needs to find its own sweet spot – a ‘signature ratio’ that is in-line with its unique reality eco-system. According to Deloitte, the proportion of Fixed to Variable would hover around 85:15 in general, touching 50-75% of Fixed pay at CXO and senior levels.

A ‘Performance’ or ‘Efficiency Loop – a happy version of the more common vicious cycle – unleashes untapped potential and resets motivation, increasing workforce efficiency and impact by many times. Don’t be surprised if almost overnight, your KPI’s and Target Boxes are getting ticked off at triple speed! As a happy bonus, this lifts morale and creates a joyous place to work.

- STOP COMPETITION FROM POACHING YOUR BEST PERFORMERS.

When you optimize your finances with the ‘magic‘ of variable pay, you can avoid laying off your rockstars if business runs into choppy waters. An elastic pay structure not only lets you retain top performers, but also gets them to perform ‘miracles’ – yes even when the chips are down - turning your business into a happy aberration.

No wonder companies across sectors like Retail, BFSI, Chemical, FMCG, IT, e-commerce and telecom are hiking their variable component by upto 25 % to attract and retain talent, since their experience suggests that best performers relish the idea of being rewarded for their merit and hard work.

- SURVIVE ON LEANER RESOURCES, THRIVE ON THINNER MARGINS.

Variable Pay matrices lighten the yoke of fixed costs on the company’s coffers – often significantly. Indeed, a strategic, reward-first approach to productivity lets teams take a big step towards the ‘Holy Grail’ of businesses in the #NewNormal age: DOING MORE, WITH LESS. By footing only those bills that bring in value, leaders can eliminate unnecessary operations, re-channelize resources better and amp up efficiency across the ranks.

3 WAYS TO BUILD CAPABILITIES THAT CAN HELP YOU SHIFT TO AN INCENTIVE-BASED MODEL

While we are still in the early stages and the codes are changing everyday, here are some insights and learnings from the industry that can help us implement and institutionalize a performance based incentive program during – and after - the crisis phase:

Steps to shifting to a incentive based model

1. CHANGE THE MINDSET.

It all starts with a revamp in mindset. A variable-heavy compensation structure delivers its full benefit only when everyone is aligned with the vision and equally kicked about the possibilities. In other words, workers need to be just as gung-ho as the founder or top leadership. There will be hurdles to handle, naturally. ‘Memories’ and ‘Inertia’ of the status-quo may linger stubbornly across organizational workflows, and one will have to learn to ignore them. There will be resistance from a slice of the team and culture that’s comfortably settled in the old way (where ‘fixed’ outweighed ‘variable’) and that’s where the transformation should hammer most. Workshops and Demo’s of new technologies and practises being introduced to facilitate change, hand-holding during micro-moments at work and the occasional inspirational speech by first-adopters – can all go to make the crossover a little easier, and a little more seamless.

2. FIND YOUR RIGHT OPERATING-MODEL FIT.

Change typically doesn’t come with a Playbook, leaving us to feel and figure out directions and intensities that will work best for us. The WHAT-WHO-WHEN-WHY-WHERE must be clear before one begins on a reward and incentive driven journey with the objective of reining in cost leaks at every step. Your business must decide on the right <fixed : variable> payout ratio in the accounts books.

You must make sure incentives are not ‘one size fit all’ but mapped to ability, motivation and personality. Your processes must be sufficiently flexible – especially during the initiating teething months of the transition - to allow for adjustments and improvisations. And you must make the extra effort to find the right transformation partner – someone who can iron out hiccups and chart expedient roadmaps with the power of experience and expertise.

In this connection, a mention of COMPASS is important : Intuitive and bespoke, COMPASS combines the art and science of engaging an in-house as well as extended-workforce and towards greater performance via incentives, and has been helping companies around the world make the leap into the unknown during the current time of uncertainty.

COMPASS helps engage your in-house as well as extended workforce for higher employee performance via incentives.

3. IMPLEMENT SLOWLY IF YOU MUST, BUT FLAWLESSLY.

While things may not be flawless straight off-the-bat, it’s important not to slacken the reins or vision. Do not compromise on the high standards you set for the other aspects of your business. And while it may take time and patience (be it habits or silos), ensure that your revamped incentive-first performance model is ultimately immersed and integrated into the system seamlessly, and involves every worker and stakeholder optimally. If nothing else, consider this a Beta Test and Preparation Period for the long haul. An elastic and incentive inspired style of functioning can help businesses reboot quicker and fly off the starting-block faster than your peers when the economy finds its balance back. Indeed, future-facing HR leaders expect the current disruptions in payouts and disbursement systems to be long-term (if not permanent).

Rituparna Chakraborty (Co-founder and Executive Vice-President of TeamLease Services) recently expressed in an article that even after the current crisis, companies would want to have a higher proportion of salary being moved to variable pay. In her words, “Companies have realised that traditional form of compensation are outdated and variable pay could offer more flexibility… this would continue.”

Unleash the power of Lean with Compass

Optimize costs and get more out of your teams (sales workforce, distribution channels, gig & freelancer force, BPO associates and support folks) with the power of rewards and incentives. Not just that, manage the entire process flawlessly in a few clicks. Schedule a Demo for Xoxoday Compass today.